Introduction: FATF in the Age of Financial Powerplay

In the Joint FATF-MONEYVAL Plenary, 12-13 June 2025 meeting , actions like Crypto regulation for travel and India-pakistan conflict discussion placing Pakistan under enhanced investigations for its connections to terror financing during the Pahalgam terror attack, 2025 has made headlines and brought Financial action Task force to a focal point.

The G7 established FATF in 1989 to combat money laundering. It has significantly since evolved into a broader body focused on combating terrorism financing and inappropriately using virtual assets. While on the other hand, it operates without any legal enforcement and does not have the ability to enforce any hard sanctions.This, however, clearly reflects FATF’s influence, as countries actively modify their laws, restructure institutions, and implement prescribed action plans to avoid greylisting or blacklisting.

This phenomenon of soft power that yields hard impacts is at the heart of FATF’s role in a multipolar world. FATF presents itself as a neutral technical institution, but it often makes decisions that align with the strategic interests of Western powers—particularly the G7, which continues to shape and dominate its structure.

As we lay out FATF’s evolving purpose, the India – Pakistan interaction brings to a significant case study of how G7 countries and EU has been shaping geopolitics through FATF.

The Evolution of FATF: From G7 Watchdog to Global Power Broker

The G7 and the European Commission created the Financial Action Task Force (FATF) in 1989—not as a universal body, but as a select club—amid the peak of the global war on drugs. Its mission was very narrow to explore methods of money laundering and recommended 40 coordinated actions to combat money laundering.

The events of 9/11 changed everything. The FATF quickly expanded its jurisdiction to include counter-terrorism financing (CTF). This evolution of the FATF post-9/11 involved a transition from a limited mandate to one firmly situated within a post 2001, “West’s” security and counterterrorism framework.

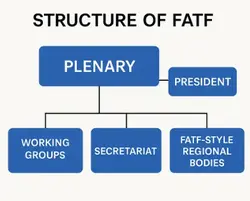

Although the FATF has evolved into a 39-member global body with affiliated organizations (FATF-Style Regional Bodies or FSRBs), the G7 and the EU—the original architects—continue to dominate its agenda-setting and decision-making processes. The FATF plenaries, mutual evaluations and grey and black listing situations regularly reflect the agenda of the developed world, particularly by countries that have the capacity to invest in financial intelligence.

Despite not being legally binding, the FATF’s Recommendations carry significant influence, largely due to the pressure they exert. Even slightly falling short of full compliance can lead to greylisting or blacklisting—outcomes that often trigger capital flight, banking restrictions, and reduced access to global financial systems. For example- Pakistan lost 38 Billion Dollars while being greylisted.

In effect, FATF has evolved from a G7 regulator to become a global regulator without legal authority to enforce its recommendations, which carry global consequences. FATF’s evolution is not merely bureaucratic; rather, it represents the evolution of geopolitical economic focus and power, wherein economic tools replace military coercion.

FATF and the Mechanics of Soft Sanctions

“Not all sanctions wear boots or carry missiles — some wear suits and carry compliance reports.”

Despite FATF’s lack of legal authority or military, it remains one of the most potent sanctioning tools in the modern era — through what analysts refer to as “soft sanctions.”

FATF as an organization cannot freeze national assets, Authorize military action, Impose economic embargoes, Punish via binding international law like UN and others does. Unlike the UN, where decisions often require unanimity or face vetoes from permanent members, the FATF operates through plenary majority voting—allowing key decisions like greylisting or blacklisting to pass without universal consensus.

Powers of FATF

FATF can segregate non-compliant countries into Greylist and Blacklist-

1. Greylisted

- Considered to be “under increased monitoring.”

- Attacks reputation on the international financial markets like IMF, World Bank etc.

- Foreign investors withdraw; banks de-risking. Example of Pakistan (greylisted 2018–2022), billions of investment withdrawal, IMF postponed.

2. Blacklisted

- Considered “non-cooperative.”

- Severe financial isolation.

- Blocked from path to international banking; e.g., SWIFT impossible to transact.

- Increased remittance costs, borrowing costs. Examples of Iran and North Korea – full blown isolation – no formal UN sanctions.

Even middle income and wealthy countries like UAE, Turkey, and Saudi Arabia, voluntarily implemented substantial increases in jurisdiction stronger reforms just to avoid embarrassment from the FATF, a clear illustration of the informal but tremendous geopolitical power of FATF.

The Western Tilt: Who Sets the Rules, Who Gets Judged?

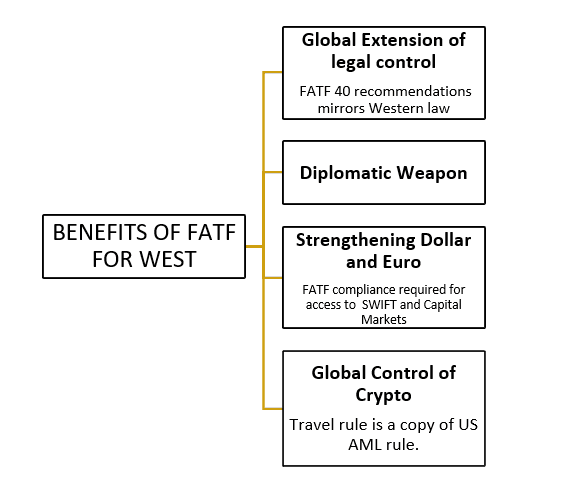

Despite FATF’s identity as a 39-member global proposal, but many of its decisions are tilted more towards the benefits of western bloc. For example- the anti terrorism guidelines came only after 9/11 when US had a blow but before that various countries too had terrorist attacks but it was not listed or considered. Following are some of the reasons that proves that FATF’s decision does have inclination towards western bloc,G-7 Countries and European Commission.

G7 Domination

All G7 countries and European comission (i.e., US, UK, France, Germany, Canada, Italy, Japan) vote and enjoys planery majority. Their experts like President elect of FATF occupy the most important positions in relation to the Mutual Evaluations.

They slant decisions towards Western strategic alignment, without an appeal process. In more vague terms, the Western world is not helping with its own observation of obligations. An example of which is that Pakistan was greylisted, but countries like Turkey or Israel had similar if not worse concerns, yet were not greylisted.

Differing Levels of Enforcement

Showing Differing Levels of Enforcement like Pakistan ( 2018-2022) was greylisted, despite reforms and compliance but Saudi Arabia? Never greylisted by FATF and in fact delisted from EU- virtually because of lobbying between the US and England.

Politically Timed Listings

Iran by FATF was blacklisted in 2020 after accepting partial compliance – at the same time as the US left the JCPOA nuclear deal. Similar timing had also been seen when the Iran sanctions were supported by the US for its interval based relationships with our allies. Here, again, another situation where FATF was reinforcing common decisions with the US.

Lack of Consequence over Identical Activities Prevalent in the West

The US and UK are centres for the development of tax havens, shell companies, or laundering of dirty money. The usual situations of heavy-handedness by investigating capacity of Anglo-Saxon countries in Ukraine, by Canada looking into laundering of money to the drug cartel, there is usually silence from FATF. US & UK are the major facilitators of illicit finance (e.g., HSBC cartel scandal, Panama Papers) but have never been greylisted.

Asymmetrical Language of Assessments-

When Developing countries has “Minor compliance issues” emphasized in reports. Developed countries with Same gaps in compliance framed in reports as “technical” deficiencies, and no negative comments.

Speed of Delisting vs Delayed Delisting

For Ex: UAE: greylisted (2022); removed (2024) within 2 years whereas it Took over 4 years to delist Pakistan, despite being actively cooperative.

Crypto, Compliance & Control: The FATF Travel Rule

FATF Travel Rule states that Exchanges must report sender/receiver details for crypto — similar to requirements for transactions in US/EU. This enforces Western surveillance norms globally- Even to countries with significantly different privacy or levels of acceptance of digital innovation. The 2019 revision that incorporated virtual assets and crypto service providers into the FATF standards was engendered largely from Western-inspired concerns about digital anonymity and cross-border terrorist financing. Beneficial ownership standards were tightened again in 2022, under G20 pressure to eliminate anonymous shell companies.

Countries like India, UAE, Singapore must comply despite differing stances — raising digital sovereignty and innovation concerns.

How does West or G7 countries Benefits from FATF?

- Strategic Role of FATF for India– Pakistan’s Greylisting (2018-2022): India played a diplomatic role by signaling Pakistan’s ineptitude addressing terror financing allowing FATF to keep it on the greylist.

2. Terror Financing Diplomacy: India utilized FATF as a forum to:

- Unveil cross border terror financing networks.

- Propose normative discussions around state-sponsored terrorism.

3. India’s Advocates for FATF Reform: India, in this context, is an advocate for reform and accountability. It proposes reform that increase:

- Equity and fairness.

- Displacing and balancing G7 influence.

- Representation of Global South.

India welcomes FATF’s punitive measures towards adversaries but would like a rules-based system based on fairness to avoid being trapped into another global finance debate (e.g crypto).

Controversy, Reforms and Future

Due to over-interference by G7 countries and global west , other members feels Frustration and a discrimination. FATF is increasingly accused of a political and opaque process. Not enough accountablity for how countries are assessed, greylisted or blacklisted has added to the problem.

Global South is now Demanding Reform like Commitment to appoint more voices from Africa, Asia, and Latin America to preparation and other decision-makings, Conducting evaluations based on rules not power based and providing more transparency on how countries are voted on and justification for posting countries on grey and black list.

Conclusion: FATF — Enforcer of Order or Instrument of Control?

“FATF has no armies, but its list can cut off economies much faster than missiles.”

FATF may lack “hard power,” but its ability to pressure sovereign nations through financial compliance, Pakistan lost approx 38 billion GDP loss due to investor fear, reduced trade, and credit downgrades— often aligned with Western interests — makes it a crucial actor in the evolving multipolar power chessboard. Its real strength lies not in coercion, but in shaping what the global economy considers acceptable behavior.

FATF’s relevance depends on: Closing the West-East divide by staying neutral in a multipolar world and Transforming from a club of powerful states to a truly global watchdog.

Stay informed on how global finance and geopolitics intersect—subscribe for more deep dives into power, policy, and international influence. Read further at https://infotrigg.com.

Read more: FATF: The “Soft Sanction Tool” in a Multipolar World- Rare Earth Minerals & Critical Minerals – India in the Global Context

- Securities Transaction Tax (STT)– Meaning, Budget Change & Market Impact

- FRBM Act , 2003: Background, Provisions and Significance for UPSC

- Ocean Currents: Causes, Types and Global Distribution for UPSC

- POCSO Act 2012 UPSC: Key Provisions & SC Debate